From Rebel to Reign

How Commerce7 ate WineDirect and Became the Monarch of Wine E-Commerce

Published by Andrew Means

January 17, 2025

A seismic shift

This afternoon my phone started blowing up, and I wasn't sure if something horrible or wonderful had happened. For many wineries, they may still not know.

What we do know is today the wine industry experienced a seismic shift: Commerce7 announced its acquisition of WineDirect's SaaS division by its parent company Fullsteam, consolidating the power of two dominant players in the direct-to-consumer (DTC) wine space. For over a decade, WineDirect was the backbone of e-commerce for many wineries, particularly small-to-medium-sized operations. Now, with the acquisition of its DTC service, wineries are facing an inflection point—a chance to modernize their digital strategies, albeit with considerable effort and significant questions about the future of competition in the space.

A pivotal moment

While the acquisition is a triumph for Commerce7, having grown up and consumed the industry leader in a few short years, it comes at a critical moment for the wine industry. WineDirect controlled a sizable portion of the market, particularly among small-to-medium-sized wineries that relied on its established infrastructure—the same small-to-medium-sized wineries that are now bearing the brunt of a changing and shrinking market. The transition to Commerce7’s more modern platform offers significant opportunities for wineries to elevate their customer experience, but it also poses challenges. How much of a toll will changing systems take? Will wineries be able or willing to learn Commerce7's capabilities enough to take advantage and see their benefit? How stable will the WineDirect platform be moving forward? Commerce7 has said it will remain operational for 2 years, but one wonders how many resources will be poured into keeping a lame duck platform running smoothly.

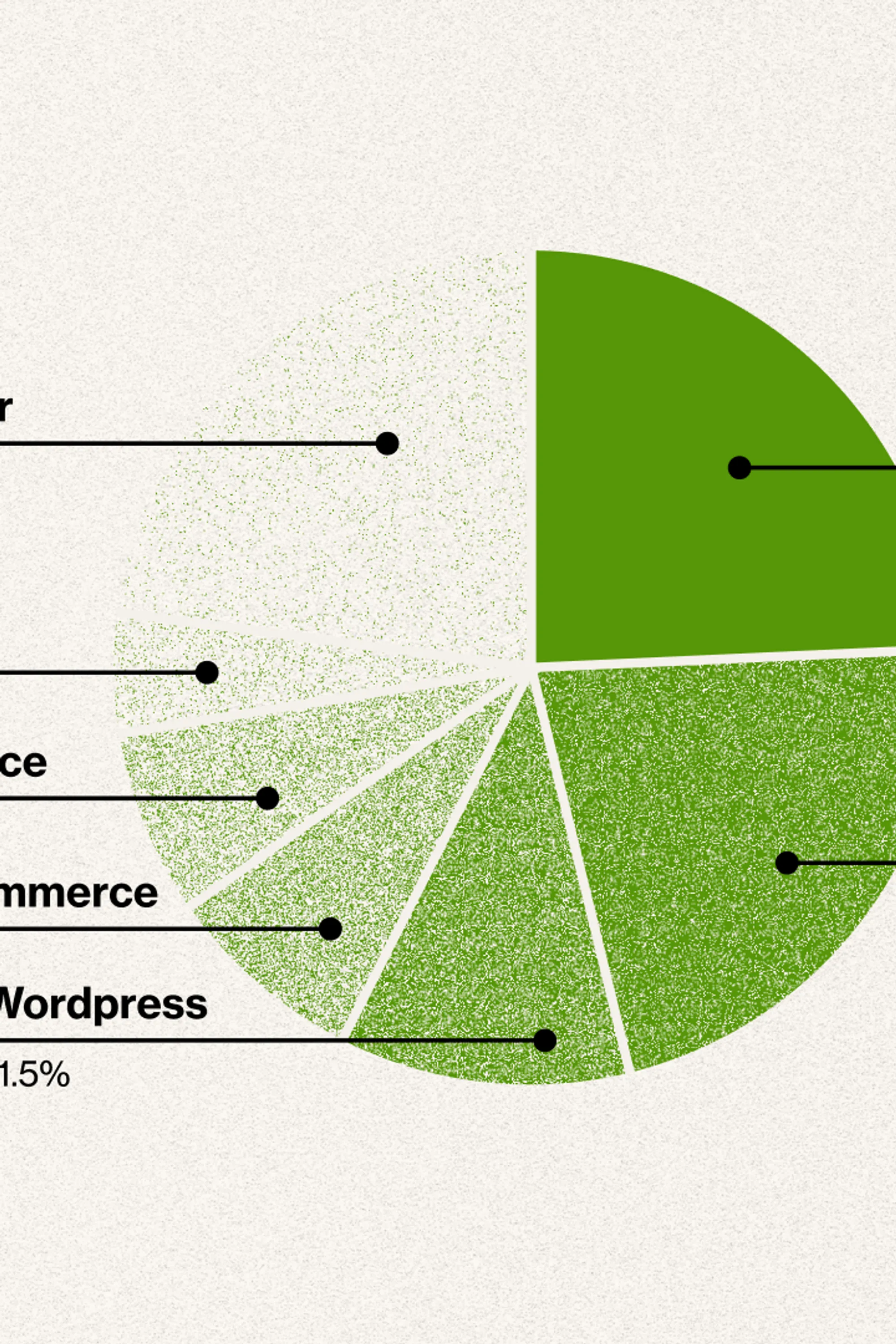

In Transom's 2024 Winery Scorecard Report, Commerce7 had narrowly outpaced WineDirect in total websites. After the acquisition, it stands to control nearly half of the market.

A New Landscape

The consolidation of the two leading e-commerce platforms changes the landscape significantly. In Transom's 2024 Sonoma Winery Scorecard Report, we found WineDirect and Commerce7 taking nearly half the market, with a smattering of other platforms following behind. As Commerce7 claims its new territory, its position approaches one of dominance.

However this lack of adoption does not mean lack of competition. For small or cash-strapped wineries platforms like VinoShipper may be more attractive than a migration to Commerce7; a downgrade in features, but an easier financial pill to swallow.

Likewise newcomer to the landscape WineHub, a Shopify plugin, pairs Shopify's robust e-commerce and POS with all the necessary tools to make selling wine online and on-premise feasible. Its impressive feature list, paired with Shopify's solid reputation, may make it an attractive option for those looking for a Commerce7 alternative.

What's Next?

As the dust settles, one thing is certain: this move represents more than just a business acquisition. It’s a reflection of broader shifts in the wine industry, where tradition and technology are colliding in new and often unpredictable ways. Wineries must now grapple with the implications of this consolidation—seizing the opportunities it provides while remaining vigilant about the challenges it may bring. Whether this marks the beginning of a new golden era for DTC wine sales or a period of homogenization remains to be seen. But one way or another, the balance of power has shifted, and the industry is watching closely.

Click Here to join Transom's email list, for more news like this.

If you have questions about wine commerce, send us an email: hello@transom.design or Book an Appointment